How to fill out Form W-4

You’ll probably fill out a W-4 when you start a job, but you can change your W-4 any time. Just download it from the IRS website, fill it out and give it to your human resources or payroll team. The easy part is supplying your name, address, marital status and other basic personal information. Here are some instructions.

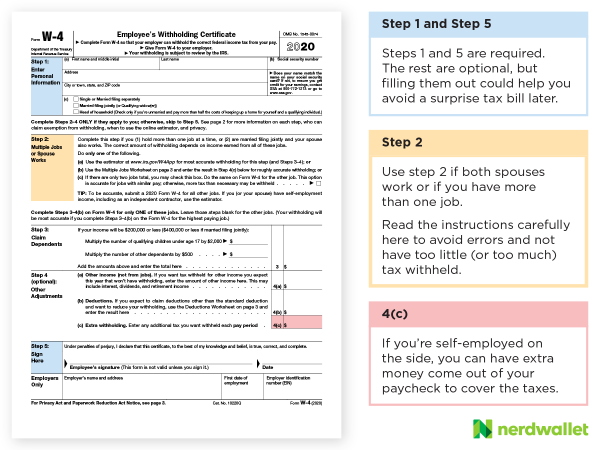

2020 Form W-4

The W-4 form also comes with a couple of worksheets that will help you figure out your withholdings, but here's a handy five-point guide:

1. The 2020 version of form W-4 does away with asking people to choose a number of allowances.

Instead, you provide certain dollar estimates for the payroll system to use.

2. If you’re single and have multiple jobs or you’re married, filing jointly and both work, remember these things:

-

You typically have to have a W-4 on file for each job.

-

For the highest paying job’s W-4, fill out steps 2 to 4(b) of the W-4. Leave those steps blank on the W-4s for the other jobs.

-

If you’re married and filing jointly, and you both earn about the same amount, you can check a checkbox indicating as much. The trick: Both spouses need to do that on each of their W-4s.

3. If you are exempt from withholding, write “exempt” in the space below step 4(c).

You still need to complete steps 1 and 5. Also, you’ll need to submit a new W-4 every year if you plan to keep claiming exemption from withholding.

4. On the 2020 W-4, you can select the Head of Household filing status.

That wasn't an option on the 2019 W-4. If you file as head of household, you may want to consider filling out the 2020 W-4 if you want the amount of taxes withheld from your pay to more accurately align with your tax liability.

5. If you don’t want to reveal to your employer that you have a second job, or you don’t want to reveal to your employer that you get income from other non-job sources, you have a few options:

-

On line 4(c), instruct your employer to withhold an extra amount of tax from your paycheck.

-

Don’t factor the extra income into your W-4. Instead of having the tax come directly out of your paycheck, send estimated quarterly tax payments to the IRS yourself instead.

from Fruitty Blog https://ift.tt/2Pp1WlR

via IFTTT

No comments:

Post a Comment