Coronavirus has well and truly turned our lives upside down. Will you still have to pay rent in self-isolation? Will you still get your Student Loan? Can you still buy pasta? So many questions...

It seems like only yesterday that the thought of self-isolating was a dystopian fantasy.

It seems like only yesterday that the thought of self-isolating was a dystopian fantasy.

But it looks like coronavirus is here to stay for a while. Universities have closed their doors until September and people are being urged to stay at home to stop the virus from spreading.

Everything seems to have come to a bit of a halt (oh, social life, how we miss you) and there's a lot of confusion right now.

This guide will help you navigate renting, Student Finance and offer some tips if you're struggling financially to cover basic needs. Rest assured – we'll get through this together and come out stronger on the other side.

Lockdowns rules to avoid the spread of COVID-19 are different depending on where you live in the UK.

Lockdowns rules to avoid the spread of COVID-19 are different depending on where you live in the UK.

Unfortunately, yes you do still have to pay rent. If you're still living in your student accommodation, you're still expected to pay rent as you usually would even if your university is no longer doing face-to-face teaching.

However, some universities agreed to waive the fees of living in halls right now so it's worth getting in touch with your uni to see if this applies to you.

For those of you who have moved back home to go into quarantine, this does not mean that you're allowed to break your contract. You're still legally obliged to pay rent until your contract's end date.

These are unprecedented circumstances thought, and we understand that paying months of rent when you're not even living in your flat adds unnecessary strain at an already stressful time.

We advise you to get in touch with your landlord or accommodation provider to explain your situation and see whether they would be open to ending your tenancy agreement early.

This means that landlords in England and Wales will not be able to evict tenants living in social or privately rented accommodation until 23rd August 2020. If they do so they are breaking the law.

In Scotland, the Coronavirus (Scotland) Act 2020 protects tenants from eviction action for up to six months starting from 7th April 2020. From that date, landlords can't evict tenants from private or social housing for six months unless the tenant engages in antisocial and criminal behaviour.

In Northern Ireland, 12 weeks notice is required from landlords before starting eviction proceedings, and Northern Irish courts are not handling eviction cases during the pandemic.

After those dates/notice periods, you'll be expected to work out an affordable payment plan that works for both of you and your landlord. If you're struggling to pay rent due to a loss of income linked to coronavirus, we suggest you get in touch with your landlord and explain your situation.

Normally, Endsleigh won't pay compensation for claims if students leave their belongings in a place nobody is living in for more than 60 days, but they've removed this condition for the remainder of the policy year.

So, if you've still got stuff in halls or in your student flat but you've been living at your parents' during the lockdown, your possessions are still insured even if no one is living at your student address.

Endsleigh has also increased cover for theft to protect students travelling home to up to £500 per bag of possessions. This only applies to students travelling within the UK.

If Endsleigh isn't your contents insurance provider, we advise you to double-check your insurer's website to see whether they're offering extra cover or increasing flexibility regarding some of their terms and conditions.

For more information on how Endsleigh are supporting customers during this time, visit their website here.

Students don't pay council tax anyway, remember!

Students don't pay council tax anyway, remember!

Any sort of accommodation occupied exclusively by full-time students will qualify for a full council tax exemption.

If you're in a shared house with both full-time students and non-students, only non-student tenants will have to pay council tax.

Some local governments have introduced measures to relieve those affected by the virus from paying their full bill. If you're living with someone that does pay council tax, tell them to get in touch with your local council to find out more.

Legally, yes, you do still have to pay your bills – but you won't have your electricity or water cut off if you're unable to pay them as a result of self-isolating.

Energy providers have recognised that their customers may find themselves in extremely precarious financial situations because of COVID-19. Emergency measures are currently being developed so that people don't find themselves without gas and electricity if they run out of money during the crisis.

If you're worried about not being able to pay your bills, get in touch with your energy provider using one of the numbers below and make them aware of your situation.

The same goes for your water bill.

Water companies are also introducing special measures such as lowering or capping tariffs and offering payment breaks. We've rounded up all their numbers below so get in touch if you think paying your water bill might be a problem for you at this time.

These measures include posting cards with emergency credit to customers in self-isolation, adding credit to your meter for you over the phone and allowing you to nominate someone to top up your meter for you.

If you need assistance to top up your meter, get in touch with your energy supplier using one of the numbers below.

As with energy bills, if you're struggling to pay for your broadband or phone contract due to a loss of income caused by coronavirus, get in contact with your service provider and explain your situation.

As with energy bills, if you're struggling to pay for your broadband or phone contract due to a loss of income caused by coronavirus, get in contact with your service provider and explain your situation.

If you were previously in a one or two-year phone contract that you're no longer bound to, we recommend you switch to a SIM-only contract.

SIM-only contracts tend to come in cheaper and often don't ask for long-term commitments, so there's more room for manoeuver if you experience a sudden loss of income.

Some operators are offering extra data and free calls to help you keep in touch with your nearest and dearest during the pandemic:

Good news: in terms of your Student Loan, it's basically business as usual.

You'll still receive the scheduled payment of your Maintenance Loan at the start of the summer term, regardless of whether or not your university has made alternative arrangements for teaching. Hooray!

Postgraduate and part-time undergraduate Student Finance for the upcoming academic year should be launched in June (but we'll keep you updated if this changes).

So following this logic, if you were to lose your job or part of your income due to coronavirus, you'd stop paying any money back as you'd no longer be earning enough to activate the repayments.

You won't be receiving an angry knock on the door if your situation changes, because the repayment system is designed to kick in once you are earning over a certain amount, not to kick you when you're down!

For more information on Student Finance and COVID-19, check out the Student Loans Company website.

All first-time UK-undergraduates are entitled to Student Finance to cover their tuition fees in full, so coronavirus doesn't change anything here. However, if your household has experienced a loss of income because of coronavirus, you may be entitled to a bigger Maintenance Loan to cover living costs.

When you apply for Student Finance, wherever in the UK you are, you're asked to provide information about your or your parents' income from the previous tax year to work out how much Maintenance Loan you're entitled to.

Usually, how much Maintenance Loan you'll get will be calculated using how much your parents earned (or how much you earned if you've self-declared as financially independent) two years ago.

As a result of coronavirus, this may not reflect the reality if your household's current situation if you or your parents have lost a job because of COVID-19 or have been put on furlough.

So, in the interest of getting a fairer payout, if your household income is at least 15% less you're allowed to provide details of your income for this current tax year instead of last year's. You must then keep your income details up to date during the year and confirm your actual income at the end of the tax year.

This is what's known as a Current Year Income Assessment, and doing this may increase your chances of getting a bigger Maintenance Loan for the upcoming academic year. It can also be used to change the amount of Maintenance Loan a student is receiving this current academic year.

So if you're in a tight spot right now because your parent has lost their job, there's a chance you could receive more than originally planned.

Students from England and Wales returning for their second year or above have had their deadline to apply for Student Finance extended until 30th June to this.

More information on changes of circumstances linked to household income here:

This is part of the Maintenance Loan and is provided to help students with living costs during their placement.

In order to be eligible, the delay must make your course year last longer than 30 weeks and 3 days and you must already be eligible for and receiving a Maintenance Loan, including the additional portion that depends on your household income.

Students doing a work placement in the UK may be eligible to receive up to £123 per week or £133 if the placement takes place abroad.

For students receiving travel grants, as long as you've spent at least 50% of your term abroad, any travel grant claims for that time abroad can still be submitted and will be processed as normal. Also, any payments already made to you will not be changed.

Students will be able to apply for any emergency discretionary payments directly to their own universities, including those at private institutions.

Universities' student support services will assess the hardship payments at their discretion and may give priority to some students based on their needs. Find out more information on this here.

Universities and higher education providers in England, Wales and Northern Ireland have also been allocated grants to put towards student hardship funds and mental health support. These grants should be available to students directly via their university.

If you're struggling financially at this time, we encourage you to approach your university to find out whether you might be eligible for a hardship fund.

If coronavirus has taken its toll on your mental health, we also encourage to approach your university's student support services as they may have created special measures to help support students better throughout this period.

Yes! Universities have now suspended lectures and tutorials and have moved all teaching to their respective online platforms. It is currently expected that face-to-face teaching will resume in September.

Yes! Universities have now suspended lectures and tutorials and have moved all teaching to their respective online platforms. It is currently expected that face-to-face teaching will resume in September.

Your university should be in touch with you to communicate what they expect from you in terms of coursework and whether any changes will be made to your workload.

So, if you've got coursework and a deadline, you're safe to assume it's business as usual unless your professors have told you otherwise!

Make a list of all the things you've got to do and give yourself a schedule if it all feels too overwhelming. The key is setting realistic goals and chipping away at it bit by bit, instead of seeing is one massive slog.

Again, it's up to your university to communicate to you whether exams will be going forward or whether they'll be postponed. Unless you've been told otherwise, our advice is to assume that your exams will still be going ahead.

Again, it's up to your university to communicate to you whether exams will be going forward or whether they'll be postponed. Unless you've been told otherwise, our advice is to assume that your exams will still be going ahead.

In the event that they do get cancelled last minute, you'll have revised loads anyway so you won't have to revise as much later on, and you'll get an awesome grade...

In light of the extremity of the disruptions COVID-19 has had on the academic year, there's a chance that some exams may be reformatted to other assignments.

Keep a close eye on both your student email address and your university's website for regular updates on any important changes made to your exam dates. Otherwise, get revising!

If you've already accepted an offer through UCAS then you're pretty much sorted!

If you've already accepted an offer through UCAS then you're pretty much sorted!

If you're worried about them withdrawing the offer once you've accepted, don't be. It's highly unlikely that the university would withdraw an offer, so should you accept it, they'll be expecting you to start uni in September.

Contact your uni if you really need the extra reassurance, but be aware that this is a busy time for them, so patience and consideration should be at the forefront of your approach.

If you've accepted an offer but want to change your mind, get in touch with your university or college and discuss this with them.

As students are currently navigating pretty exceptional circumstances, the Office for Students has said that they expect higher education providers to allow students to change their minds if they are no longer happy with their original choice.

However, we'd advise you to only get in contact with the university once you're 100% sure of your decision to avoid a constant back and forth, as well as further confusion later on.

UCAS will be able to release you from any offer you've accepted, with the permission of the university. They expect unis to grant this permission, but if this doesn't happen and the university is unwilling to free you from the accepted offer, you should contact the OfS about this.

Coronavirus has caused a lot of people to lose their jobs, or forced them to take time off work to self-isolate. If this is you, here's what to do.

Coronavirus has caused a lot of people to lose their jobs, or forced them to take time off work to self-isolate. If this is you, here's what to do.

You do need to be earning at least £118/week to qualify for statutory sick pay, which currently stands at £94.25/week.

If you were laid off as a result of the pandemic, it's definitely worth getting back in touch with your former employer as they may be able to take you on through the government's Coronavirus Retention Scheme (which we'll explain in a second).

However, it's up to your employer whether or not they decide to make up for the wages you missed during the period of redundancy.

Grants have been given to businesses so they can pay 80% of the wages of retained employees, to be capped at £2,500/month per employee. This system basically allows employers to put people's jobs on hold, or on 'furlough', and provide them with some income in the meantime.

Wages will be paid retroactively from 1st March and the system is set to run through until October 2020, which means that if you've been put on furlough, your employer should be eligible to claim until then. As usual, we'll post updates here as soon as we get them.

Companies will decide the hours and shift patterns their employees will work and will be responsible for paying their wages and from August the level of government grant provided through the job retention scheme will be reduced.

The idea is that employer payments substitute part of the government's contribution while staff continue to receive at least 80% of their original salary, up to £2,500 a month. Here's a timeline of how these changes will be put in place over the next few months:

Anyone who was employed and on their employer's PAYE payroll by 19th March of this year (the initial cut-off date of 28th February was extended by the government in April) on a full-time contract, part-time contract, through an agency, or on a flexible or zero-hours contract is eligible for furlough.

Anyone who was employed and on their employer's PAYE payroll by 19th March of this year (the initial cut-off date of 28th February was extended by the government in April) on a full-time contract, part-time contract, through an agency, or on a flexible or zero-hours contract is eligible for furlough.

Unfortunately, if you had not been put on your employer's payroll by 19th March, your employer will not be able to put you on furlough even though you were technically employed.

Foreign nationals are eligible to be furloughed, as are apprentices who may continue to train during this time (if the circumstances permit).

So if, for example, you had a job as a barista at a coffee shop which has had to temporarily close its doors, your employer could be given a grant which is designed to cover your wages while you're on standby.

Employees of individuals who aren't companies can also be put on furlough. This may be the case if you're a nanny and you were put on payroll via HMRC's PAYE scheme on or before 19th March.

If you rely on more seasonal part-time work – like, for instance, you only work during the Christmas period or over the summer – you may not be able to claim furlough.

We encourage you to discuss this with your employer and look for alternative ways to make money should this scheme not be applicable to you.

If you had left a job to start a new one which fell through as a result of COVID-19, you may also still be entitled to furlough.

The government has also said that companies can rehire former employees that left their jobs after 28th February (the initial cut-off date) for a new job elsewhere that no longer exists because of coronavirus, in order to put them on furlough and provide them with an income.

The government have said that while you're on annual leave, you'll need to be paid your full holiday pay. So if you're only receiving 80% of your salary at the moment your employer will need to make up the 20% so that you're receiving your full holiday pay while you're on annual leave. Show your employer this if they're not following the rules!

If you do part-time freelance work or any other form of self-employment, help is coming for you too.

The Coronavirus Self-employment Income Support Scheme has been rolled out to allow the self-employed to claim a taxable grant worth up to 80% of how much they were making before COVID-19 hijacked our day-to-day lives.

The grant is paid out in one instalment covering three months (March, April and May) and is capped at £7,500.

A second grant will be available from August. It will be worth 70% of average monthly trading profits, paid out in a single instalment covering three months’ worth of profits, and capped at £6,570 in total.

If you are eligible for the grant you can still work during this time (if you can), start a new trade or take on other employment.

HMRC will work out your average trading profit by adding together your total trading profits or losses for the three tax years, which will then be divided by three (the online service will tell you how HMRC worked it out in more detail). The end result will be how much you are entitled to.

The Self-employment Income Support Scheme has been live since 13th May. However, HMRC's website states that you should use their online tool to find out whether or not you'll be eligible for a grant before you make a claim.

If this tool says that you are eligible, HMRC will give you a date on which you'll be able to make a claim and you'll also be asked to add in your contact details so they can get in touch with you if need be.

To be able to use this tool, you'll need to have your Self Assessment Unique Taxpayer Reference (UTR) number and your National Insurance number to hand. If you don't have these, there's a link to where you can find them in the following section.

You can make a claim for Universal Credit while you wait for the grant. Any support you get from this Self-employment Income Support Scheme may affect how much Universal Credit you get from here on out, but should not affect claims for earlier periods.

Otherwise, contact HMRC here and ask them to review your situation.

As summer is still a way off, not all festivals have been cancelled – but it's likely that the majority will be.

Glastonbury 2020 has officially been cancelled, and the organisers are offering two options for people who've already paid the deposit on their tickets: a complete refund, or the possibility of rolling over their deposit for next year, ensuring tickets for Glastonbury 2021.

If you've bought a ticket for a festival, concert, play or other event that has been cancelled, you should get a refund.

According to Ticketmaster's policy:

Don't forget to check your travel insurance if you've had to cancel any transport you had booked to get to your concert or festival!

Now we're all living that working/studying from home life, going to the gym is (temporarily) a thing of the past.

PureGym, Nuffield and The Gym Group are freezing their customers' memberships while freedom of movement is restricted, during which time they won't be charged.

Check your gym's webpage to find out what their response has been to COVID-19, and don't hesitate to get in touch with them if you feel that you may have been wrongly charged for services you won't be able to use.

There are loads of ways to stay fit and healthy without going to the gym anyhoo!

Eek. There's less live sport to stream, so can you get a refund on your Sky Sports subscription?

Eek. There's less live sport to stream, so can you get a refund on your Sky Sports subscription?

BT Sport and Sky Sports customers (including customers subscribing to these packages via other providers) were able to pause their subscription free of charge during March, April and May as there was almost no live sport taking place.

However, the men's Premier League and Championship football are both due to restart in June, with golf and snooker resuming too. As some sports events are returning, both providers have said that they'll start charging their customers again from mid-June.

More information for customers via the links below.

You should also be entitled to a refund for any partially used tickets (i.e. when only one of the journeys has been completed), also with no admin fee.

There are some cases where Advance tickets won't be eligible for a fee-free refund, so we suggest you double-check with your operator before going ahead.

Buses will continue to run but at a reduced capacity and night buses are still running to support those having to complete essential travel to work night shifts.

Coach companies are reducing or completely suspending their services.

Coach companies are reducing or completely suspending their services.

Megabus have said that customers with travel booked on services in England and Wales after 5 April will receive an email and be refunded.

If you had a trip booked with Megabus but haven't received an email with your refund, the company has advised that you get in touch with their Customer Services Team by emailing enquiries@megabus.com.

So, we're all supposed to stay at home. But what about that upcoming trip to Ibiza you had planned with the lads?

The Foreign and Commonwealth Office is advising British nationals against all but essential international travel. This means that it is advisable to cancel any holidays and other non-essential trips abroad you had planned (including your sesh in Ibiza, soz).

Airlines are introducing new policies for customers cancelling their trips as a result of the pandemic. These involve either waiving admin fees on any amendments made to bookings, giving customers a voucher towards their next trip or providing a full refund.

If you booked your flight through a third-party flight search engine like Skyscanner or Momondo, check the travel company your deal was secured with (their name should be on your reservation email) before getting in touch with the airline.

As their phone lines are extremely busy at this time, their Customer Services teams might prioritise only the most imminent departures (i.e. flights booked for within the next seven days, like Opodo is doing) and may very well tell you to get in touch with the airline directly. That said, it's still worth giving their webpage a gander.

As their phone lines are extremely busy at this time, their Customer Services teams might prioritise only the most imminent departures (i.e. flights booked for within the next seven days, like Opodo is doing) and may very well tell you to get in touch with the airline directly. That said, it's still worth giving their webpage a gander.

At this point, we'd like to remind you that, according to EU air passengers' rights rules (yes, they still apply to us for now), you are entitled to a refund as opposed to just a voucher if the airline has cancelled your flight.

If you're 100% sure that you'll be making the trip, rebook away to your heart's delight. But know that if the airline goes bust and you opted for the voucher, the likelihood of you getting your money back is close to zilch.

According to EU rules, you have 12 months to make the claim, so choose wisely.

Here's what the most popular airlines in the UK are doing as a response to COVID-19:

Unfortunately, it has been reported that some airlines are making it increasingly difficult to obtain a refund even if flights have been cancelled (and refunding customers for cancelled flights was part of their original policy, angryface) by forcing customers to call in during this particularly busy period.

If you're currently in this situation, there are a few different things you could try, one of them being using an alternative number to the one that has been sign-posted for COVID-19 related cancellations.

This website provides alternative free numbers for some of the UK's biggest service providers to increase your chances of interaction with an actual human being. Result!

You might also want to try an online refund request form if the airline provides one somewhere else on their website. Again, we know this is far from ideal, but couldn't do any harm right?

Lastly, your debit/credit card may also be able to help you out.

Credit card providers have to ensure purchases of over £100 under Section 75 of the Consumer Credit Act. If you bought a flight worth over £100 using your credit card, legally your credit card provider has to give you the money back as you cannot owe credit for a service you didn't receive.

Debit cards benefit from something called chargeback protection. This means that if you don't receive the goods or services you paid for, you may be able to claim your money back.

Bad news though, chargeback isn't a legal protection that banks have to provide the way Section 75 is, so you'll have to check if this is a service your bank provides. If it is, give your bank a bell and ask them to start the process.

Reservations for stays or Airbnb Experiences made on or before 14th March, with a check-in date between 14th March and 20th July, may be cancelled before check-in and are covered by the company's COVID-19 extenuating circumstances policy.

Guests who cancel will receive a full refund and Airbnb will refund all service charges.

Reservations for stays and Airbnb Experiences made after 14th March will not be covered by Airbnb's COVID-19 policy, unless the guest falls ill with coronavirus. If this isn't the case, the host’s cancellation policy will apply as usual if the guest wishes to cancel.

To receive an actual refund (which you are absolutely entitled to under EU law), you must wait until you've received your refund credit to use Tui's customer online refund form. For more information, click here.

Customers who have a booking between 30th June 2020 and 31st August 2020 can amend to another time, but they must do it before 30th June 2020.

A lot of countries have closed their borders or are seriously restricting incoming travel. Most insurance companies will cover cancelled trips if there's an FCO advisory in place, which there is at the moment.

So yes, if you have an imminent upcoming trip for which you've shelled out on non-refundable flights (and the airline's policy isn't very forthcoming), accommodation reservations, tours or other add-ons, you should be able to claim your expenses back from your insurer.

When the FCO advisory lifts, however, it may be a different story. Insurers tend to make the decision to pay out or not based on the Foreign Office's travel advice so keep your eyes peeled.

If the insurer turns down your claim and you think you have may have been treated unfairly, you can make a complaint.

If the insurer turns down your claim and you think you have may have been treated unfairly, you can make a complaint.

Financial service providers such as insurers must deal with complaints within eight weeks, so make sure you put 'Complaint' in the subject line to ensure your email is prioritised.

Include all essential information, such as dates, names of people you spoke to, flight numbers and bookings. Also state how you would like your complaint to be resolved (i.e. compensation for your cancelled hols).

Make sure you write down people's names if you speak to anyone over the phone, and try and get any phone conversations summarised in an email.

If no response is given within these eight weeks, you can go to the Financial Ombudsman (for free) to take your complaint further.

If you decide you no longer want to go on a flight you'd booked which hasn't yet been cancelled and is outside the key periods mentioned in the table above, you're not legally entitled to a refund from the airline or your insurer (if you bought holiday insurance).

That's because this is what's known as disinclination to travel – which is basically a fancy way of saying I don't want to go on holiday anymore.

The same thing applies if you went through a travel agent or other holiday firm. Wait for them to cancel to make sure you're legally guaranteed a refund. If you're deadset on staying home, approach the airline or travel company and ask them about moving the date or giving you a voucher.

For those of you with travel insurance, remember that each insurer has its own policy regarding how far in advance they'll accept claims and getting a refund in these circumstances is unchartered territory.

There's still so much uncertainty around how long the pandemic will last, so you'll have to get in touch with your insurer if you're thinking of asking for your money back.

The FCO will likely extend its advice against all but essential travel, and travel insurance that covers you for coronavirus-related cancellations is nigh on impossible to find (as this is a highly likely scenario which would force insurers to pay out thousands of pounds).

You risk losing out on a fair bit of cash, and either way, most of the tourist attractions will probably be shut for social distancing purposes. It's a lose-lose situation!

Please note that if you are planning on travelling, most airlines will expect you to bring and wear a facemask during your flight. If you do not, you may not be allowed to board your flight.

In response to mass panic buying which has left supermarkets absolutely ransacked (angryface), limits have been imposed on the quantities of certain products that you can buy at once.

In response to mass panic buying which has left supermarkets absolutely ransacked (angryface), limits have been imposed on the quantities of certain products that you can buy at once.

Most supermarket chains (not all) are restricting customers to purchasing a limited number of the same item, and have placed additional restrictions on in-demand items such as pasta, loo roll and hand sanitiser.

Here's a table containing the rations imposed by the UK's biggest supermarkets:

*In-demand items vary from supermarket to supermarket and may include but are not limited to toilet roll, pasta, hand sanitiser, soap, paracetamol, tinned goods and UHT milk.

Remember, only buy what you really need at the supermarket – that extra tin of baked beans could really make the difference to someone who hasn't had a hot meal in days.

If you're more of an online food shopper, your order may take a little longer to arrive than usual due to the spike of people staying at home (delivery slots are getting booked up weeks in advance).

Look at the food you've currently got, work out how long it'll last you and try and plan your order accordingly.

It goes without saying that now really is the time to make the most of the food you've already got at home.

Make sure your food is properly stored so it'll last you as long as possible. If you think you won't get to something before it goes off, most (but not all) foods can be frozen.

Cooking can quickly get boring when you're in self-isolation and have to cook for yourself twice a day. Check out our student meal plan for recipes that are easy to make and will keep you going for over a month!

If you're running low on money for food and borrowing money from your parents isn't an option, get in touch with your university's support services.

If you're running low on money for food and borrowing money from your parents isn't an option, get in touch with your university's support services.

Student unions at some universities have been setting up food banks to support students whose Maintenance Loan isn't making ends meet at this time. If this includes you, get in touch with your university's student union and make your situation known to them.

You're not alone in this – there are more students in this position to you than you might think. Some supermarkets are also setting up emergency care boxes for the most vulnerable, so it's worth checking their social media and webpages to see if this is happening at one near you.

Whatever you do and however easy it may seem, don't turn to private loan providers. We've got loads of alternatives to those here.

If you'd prefer to avoid touching keypads all together, you can use contactless payments like Apple Pay on your iPhone, or Google Pay if you have an Android phone.

There is currently no spending limit on either of these but some retailers may apply the same limit as contactless payments.

Shops selling non-essential goods (i.e. your faves Primark, H&M, Topshop, etc.) have been ordered to close during the coronavirus outbreak. But fret not, online shopping is still on the cards!

Shops selling non-essential goods (i.e. your faves Primark, H&M, Topshop, etc.) have been ordered to close during the coronavirus outbreak. But fret not, online shopping is still on the cards!

However, this does making returning items that don't fit/are faulty a bit more challenging than usual.

Luckily, most retailers have announced that they'll extend the timeframe on their returns policy during the pandemic and lots are offering free delivery.

If you've bought something through Klarna that hasn't been delivered because of coronavirus, you can report the problem on the Klarna app. Select 'Report a problem' on your order and then 'I did not get my delivery'. This will pause the payment temporarily to give you time to resolve the issue with the vendor.

If you need to return something you ordered via Klarna but are unable to physically go to the Post Office, you'll first need to get in contact with the vendor to make alternative arrangements.

Then, report the return by selecting 'Report a return' on the Klarna app so they can pause your payment until the vendor confirms they've received the return.

You can call Klarna on 0808 189 3333 or contact them via their chat.

The Financial Conduct Authority (FCA), the entity that regulates banks in the UK, has said that banks need to take steps to provide financial relief for customers impacted by coronavirus. These measures will be effective until 31st October 2020. Here are the most noteworthy changes taking place:

The Financial Conduct Authority (FCA), the entity that regulates banks in the UK, has said that banks need to take steps to provide financial relief for customers impacted by coronavirus. These measures will be effective until 31st October 2020. Here are the most noteworthy changes taking place:

Most banks are applying this automatically their Current Account customers with arranged overdrafts, but it's worth checking your bank's website to see if your account is eligible and whether or not the buffer needs to be requested by the account-holder.

On top of interest-free overdrafts, banks are also offering temporary payment holidays or freezes for customers with credit cards. However, you'll still be charged interest during the repayment holiday, so it may be worth continuing with the payments if possible.

The FCA has said that banks must ensure that customers using any of these temporary measures will not see their credit score negatively affected as a result.

So if you do have to resort to any of these measures, you shouldn't be punished for it further on down the line!

Companies are offering payment freezes to customers who are struggling to keep up their payments on their car finance due to coronavirus.

The authority has also said the firms should not take steps to end the agreement or repossess cars if customers aren't able to complete their payments.

More information on this here.

When the payment holiday ends, companies should arrange for customers to pay back what they owe in a way that isn't financially detrimental to them, be it in one payment or in several instalments.

Customers using buy-now-pay-later services will also be given payment freezes. Interest will continue to accrue, however, unless the customer currently benefits from a promotional interest-free or low-interest period.

More information on this here.

Credit: ffikretow@hotmail.com – Shutterstock

But it looks like coronavirus is here to stay for a while. Universities have closed their doors until September and people are being urged to stay at home to stop the virus from spreading.

Everything seems to have come to a bit of a halt (oh, social life, how we miss you) and there's a lot of confusion right now.

This guide will help you navigate renting, Student Finance and offer some tips if you're struggling financially to cover basic needs. Rest assured – we'll get through this together and come out stronger on the other side.

What are coronavirus lockdown rules?

Credit: Antonio Rico – Shutterstock

Lockdown restrictions in England

- If you live alone you can form a 'support bubble' with one other household, meaning you can spend time together inside each other's homes and do not need to stay two metres apart.

- You can meet outdoors in groups of up to six people from different households who are not in your support bubble, provided social distancing is observed.

- You can attend your place of worship for individual prayer as well as non-essential shops, drive-in cinemas, zoos and safari parks.

- You must wear a face-covering on public transport.

- You can take unlimited amounts of outdoor exercise.

Changes to lockdown rules in England from 4th July

- From 4th July, the two-metre social distancing rule will be changed. Where it is not possible to stay two metres apart, people should keep a distance of at least one metre while observing precautions to reduce the risk of transmission of the virus.

- Restaurants and pubs will also be allowed to reopen providing they stick to strict guidelines. Indoor areas will only be used for people dining in, and contact between staff and customers will be limited. Customers will also have to give contact details when they enter a pub or restaurant.

- Hotels, B&Bs, cottages, campsites, caravan parks can also reopen and people will be able to stay away from home overnight.

- Two households of any size will be able to meet indoors or outside. It will be possible to stay overnight. The government has advised against meetings of multiple households indoors because of the risk of transmission.

- People from multiple households can meet outdoors in groups of up to six, but two households can meet regardless of size.

- The following public places will be able to reopen from 4th July: places of worship, libraries, community centres, bingo halls, cinemas, museums and galleries, along with funfairs and theme parks, amusement arcades, outdoor skating rinks, indoor leisure centres, social clubs and model villages (we know students love a model village).

- The following public places will still be closed from 4th July: indoor gyms, nightclubs, casinos, bowling alleys, spas, swimming pools, theatres and concert halls.

Lockdown rules in Northern Ireland

- Groups of up to six people who do not share a household can meet up outdoors while observing social distancing.

- Outdoor activities and sports that do not involve shared contact with hard surfaces, such as golf, water sports and tennis, are allowed.

- Opticians, homeware shops, motor and bicycle retail and repair businesses, office product retailers, electrical stores, IT businesses and phone shops and repairers are open.

- Churches are open for drive-through services and individual prayer while observing social distancing is also allowed.

Lockdown rules in Scotland

- You may only go outside for essential food, health and work reasons.

- People from two households can meet outside but groups of no more than eight people should meet at a time.

- You can do outdoor activities where physical distancing can be maintained, although the Scottish Government advises that you should not go further than five miles for recreation.

Changes to lockdown rules in Scotland

- 29th June: Non-essential shops, indoor workplaces, zoos, outdoor markets, outdoor sports courts and playgrounds can reopen.

- 3rd July: The five-mile travel distance will is relaxed, most self-catering holiday homes and second homes can also be used.

- 6th July: Outdoor hospitality, e.g. beer gardens, can reopen.

- 10th July: People can meet in groups outdoors (no limit to the number of households) and can meet with two other households indoors.

- 13th July: Shopping centres, outdoor contact sports for children and dentists can reopen.

- 15th July: Pubs, restaurants, hairdressers, barbers, museums, cinemas, libraries, childcare and all holiday accommodation can reopen.

- Theatres, nightclubs and bingo halls will not reopen for now and indoor gyms are still under consideration.

Lockdown rules in Wales

- People from two different households can meet each other outdoors while maintaining social distancing.

- You're not allowed to go more than five miles away from your household for leisure (you'll be risking a fine if you do).

Paying rent and bills during the coronavirus pandemic

Some students have stayed in halls, some have gone back home to their parents' house. Here's what to do if you live at university or if you've moved back home:Do you still have to pay rent if you've been affected by coronavirus?

Unfortunately, yes you do still have to pay rent. If you're still living in your student accommodation, you're still expected to pay rent as you usually would even if your university is no longer doing face-to-face teaching.

However, some universities agreed to waive the fees of living in halls right now so it's worth getting in touch with your uni to see if this applies to you.

For those of you who have moved back home to go into quarantine, this does not mean that you're allowed to break your contract. You're still legally obliged to pay rent until your contract's end date.

These are unprecedented circumstances thought, and we understand that paying months of rent when you're not even living in your flat adds unnecessary strain at an already stressful time.

We advise you to get in touch with your landlord or accommodation provider to explain your situation and see whether they would be open to ending your tenancy agreement early.

Will you be evicted if you can't pay rent because of coronavirus?

The coronavirus pandemic has caused some businesses to go bust or left them unable to pay their employees' wages, which in turn has affected their ability to pay rent. Fortunately, the Housing Secretary has announced an eviction ban that will protect renters over the summer.This means that landlords in England and Wales will not be able to evict tenants living in social or privately rented accommodation until 23rd August 2020. If they do so they are breaking the law.

In Scotland, the Coronavirus (Scotland) Act 2020 protects tenants from eviction action for up to six months starting from 7th April 2020. From that date, landlords can't evict tenants from private or social housing for six months unless the tenant engages in antisocial and criminal behaviour.

In Northern Ireland, 12 weeks notice is required from landlords before starting eviction proceedings, and Northern Irish courts are not handling eviction cases during the pandemic.

After those dates/notice periods, you'll be expected to work out an affordable payment plan that works for both of you and your landlord. If you're struggling to pay rent due to a loss of income linked to coronavirus, we suggest you get in touch with your landlord and explain your situation.

Coronavirus and contents insurance

Endsleigh has said it will be more flexible regarding students who've left their student accommodation at short notice to return home during the lockdown.Normally, Endsleigh won't pay compensation for claims if students leave their belongings in a place nobody is living in for more than 60 days, but they've removed this condition for the remainder of the policy year.

So, if you've still got stuff in halls or in your student flat but you've been living at your parents' during the lockdown, your possessions are still insured even if no one is living at your student address.

Endsleigh has also increased cover for theft to protect students travelling home to up to £500 per bag of possessions. This only applies to students travelling within the UK.

If Endsleigh isn't your contents insurance provider, we advise you to double-check your insurer's website to see whether they're offering extra cover or increasing flexibility regarding some of their terms and conditions.

For more information on how Endsleigh are supporting customers during this time, visit their website here.

Do you still have to pay council tax during the pandemic?

Credit: Zoltan Fabian – Shutterstock

Any sort of accommodation occupied exclusively by full-time students will qualify for a full council tax exemption.

If you're in a shared house with both full-time students and non-students, only non-student tenants will have to pay council tax.

Some local governments have introduced measures to relieve those affected by the virus from paying their full bill. If you're living with someone that does pay council tax, tell them to get in touch with your local council to find out more.

Do you still have to pay energy and water bills?

Legally, yes, you do still have to pay your bills – but you won't have your electricity or water cut off if you're unable to pay them as a result of self-isolating.

Energy providers have recognised that their customers may find themselves in extremely precarious financial situations because of COVID-19. Emergency measures are currently being developed so that people don't find themselves without gas and electricity if they run out of money during the crisis.

If you're worried about not being able to pay your bills, get in touch with your energy provider using one of the numbers below and make them aware of your situation.

The same goes for your water bill.

Water companies are also introducing special measures such as lowering or capping tariffs and offering payment breaks. We've rounded up all their numbers below so get in touch if you think paying your water bill might be a problem for you at this time.

Help for prepaid meter customers

Energy providers have stepped up measures to help customers using pay-as-you-go meters who may have trouble physically making it to the shops to top up their gas and electricity during the pandemic.These measures include posting cards with emergency credit to customers in self-isolation, adding credit to your meter for you over the phone and allowing you to nominate someone to top up your meter for you.

If you need assistance to top up your meter, get in touch with your energy supplier using one of the numbers below.

Helplines for energy providers

| Energy supplier | Number |

|---|---|

| British Gas | 0333 202 9802 |

| Bulb | 0300 303 0635 |

| EDF | 0333 200 5110 |

| EON Energy | 0345 052 0000 |

| N Power | 0800 073 3000 |

| Scottish Power | 0800 027 0072 |

| SSE | 0345 026 2658 |

Helplines for water suppliers

| Water supplier | Helpline |

|---|---|

| Affinity Water | 0345 357 2402 |

| Albion Water | 03300 242020 |

| Anglian Water | 0345 791 9155 |

| Bristol Water | 0345 702 3797 |

| Cambridge Water | 01223 706050 |

| Cholderton and District Water | 01980 629203 |

| Dee Valley | 01978 833200 |

| Essex and Suffolk Water | 0345 782 0111 |

| Independent Water Networks | 02920 028 711 |

| Northern Ireland Water | 03457 440088 |

| Northumbrian Water | 0345 733 5566 |

| Portsmouth Water | 023 9249 9666 |

| Scottish Water | 0800 0778 778 |

| Severn Trent Water | 03457 500 500 |

| South East Water | 0333 000 0001 |

| South West Water | 0344 346 2020 |

| Southern Water | 0330 303 0368 |

| Sutton and East Surrey Water | 01737 772000 |

| Thames Water | 0800 316 9800 |

| United Utilities Water | 0345 672 2888 |

| Welsh Water | 0800 052 0145 |

| Wessex Water | 0345 600 3 600 |

| Yorkshire Water | 0345 124 2424 |

What if you can't afford your phone contract or broadband?

Credit: sergey causelove – Shutterstock

If you were previously in a one or two-year phone contract that you're no longer bound to, we recommend you switch to a SIM-only contract.

SIM-only contracts tend to come in cheaper and often don't ask for long-term commitments, so there's more room for manoeuver if you experience a sudden loss of income.

Some operators are offering extra data and free calls to help you keep in touch with your nearest and dearest during the pandemic:

- Sky Mobile – Customers will get an extra 10GB data boost for free until April which will be added to your Piggybank.

- Three Mobile – Three are reducing their International Saver Add-on price from £15.32 to £10 for 31 destinations around the world.

- Virgin Mobile – Pay Monthly customers will get unlimited minutes to mobile and landline numbers, plus an extra 10GB data boost for free for one month. Virgin Media is also giving customers with a telly package 18 free channels until 2 May, which will be automatically added to their account.

- Vodafone – Free unlimited data for 30 days via VeryMe Rewards (automatically applied to customers flagged as particularly vulnerable).

Here are some quick and easy ways to make money if your bank balance could do with a top-up. There are even some ways you can get money for free!

How will coronavirus affect Student Finance and going to university?

Most universities now won't be opening their doors again until September 2020. Here's what to do in the meantime.Will your Student Loan still be available during coronavirus?

Good news: in terms of your Student Loan, it's basically business as usual.

You'll still receive the scheduled payment of your Maintenance Loan at the start of the summer term, regardless of whether or not your university has made alternative arrangements for teaching. Hooray!

Can students still apply for Student Finance during the pandemic?

Yes! If you're currently studying or if you'll be starting a new full-time undergraduate course after 1st August 2020, you can apply for Student Finance as normal.Postgraduate and part-time undergraduate Student Finance for the upcoming academic year should be launched in June (but we'll keep you updated if this changes).

Do you have to repay your Student Loan if you can't work because of coronavirus?

The Student Loans Company only take repayments if you're earning over the repayment threshold for your repayment plan.So following this logic, if you were to lose your job or part of your income due to coronavirus, you'd stop paying any money back as you'd no longer be earning enough to activate the repayments.

You won't be receiving an angry knock on the door if your situation changes, because the repayment system is designed to kick in once you are earning over a certain amount, not to kick you when you're down!

For more information on Student Finance and COVID-19, check out the Student Loans Company website.

Will a loss of household income affect how much Student Finance students get this year and next year?

If your household has experienced a loss of income due to COVID-19, this may affect how much Student Finance you get for the upcoming academic year (in a good way!).All first-time UK-undergraduates are entitled to Student Finance to cover their tuition fees in full, so coronavirus doesn't change anything here. However, if your household has experienced a loss of income because of coronavirus, you may be entitled to a bigger Maintenance Loan to cover living costs.

When you apply for Student Finance, wherever in the UK you are, you're asked to provide information about your or your parents' income from the previous tax year to work out how much Maintenance Loan you're entitled to.

Usually, how much Maintenance Loan you'll get will be calculated using how much your parents earned (or how much you earned if you've self-declared as financially independent) two years ago.

As a result of coronavirus, this may not reflect the reality if your household's current situation if you or your parents have lost a job because of COVID-19 or have been put on furlough.

So, in the interest of getting a fairer payout, if your household income is at least 15% less you're allowed to provide details of your income for this current tax year instead of last year's. You must then keep your income details up to date during the year and confirm your actual income at the end of the tax year.

This is what's known as a Current Year Income Assessment, and doing this may increase your chances of getting a bigger Maintenance Loan for the upcoming academic year. It can also be used to change the amount of Maintenance Loan a student is receiving this current academic year.

So if you're in a tight spot right now because your parent has lost their job, there's a chance you could receive more than originally planned.

Students from England and Wales returning for their second year or above have had their deadline to apply for Student Finance extended until 30th June to this.

More information on changes of circumstances linked to household income here:

- Student Finance England

- Student Finance Wales

- Student Finance Northern Ireland

- SAAS (Scottish Student Finance)

Loans for students on work placements that have been delayed

If you're a student who has been on a work placement which has been delayed because of coronavirus, you may be eligible for what's known as a Long Courses Loan.This is part of the Maintenance Loan and is provided to help students with living costs during their placement.

In order to be eligible, the delay must make your course year last longer than 30 weeks and 3 days and you must already be eligible for and receiving a Maintenance Loan, including the additional portion that depends on your household income.

Students doing a work placement in the UK may be eligible to receive up to £123 per week or £133 if the placement takes place abroad.

Student Finance for students who were studying abroad

Students completing a year abroad who have had to come back and are now completing their studies remotely from their homes will still receive Student Finance for their tuition fees and living costs as planned.For students receiving travel grants, as long as you've spent at least 50% of your term abroad, any travel grant claims for that time abroad can still be submitted and will be processed as normal. Also, any payments already made to you will not be changed.

Further information on Student Finance and coronavirus

- Student Finance England

- Student Finance Wales

- Student Finance Northern Ireland

- SAAS (Scottish Student Finance)

Coronavirus hardship fund

The Scottish Government announced on 8 April that they would be providing an emergency fund to help students in Scotland facing hardship as a result of COVID-19.Students will be able to apply for any emergency discretionary payments directly to their own universities, including those at private institutions.

Universities' student support services will assess the hardship payments at their discretion and may give priority to some students based on their needs. Find out more information on this here.

Universities and higher education providers in England, Wales and Northern Ireland have also been allocated grants to put towards student hardship funds and mental health support. These grants should be available to students directly via their university.

If you're struggling financially at this time, we encourage you to approach your university to find out whether you might be eligible for a hardship fund.

If coronavirus has taken its toll on your mental health, we also encourage to approach your university's student support services as they may have created special measures to help support students better throughout this period.

Should you still do your coursework?

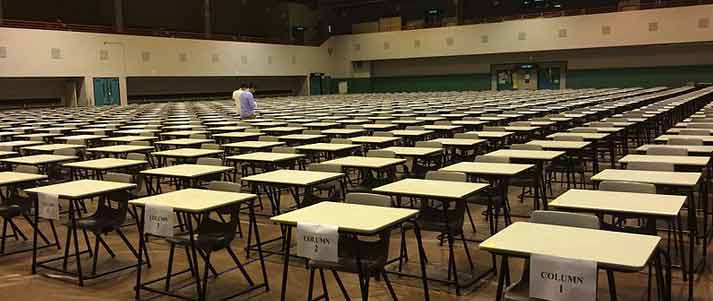

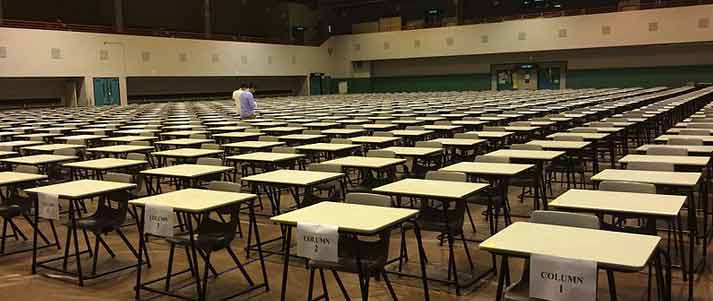

Credit: Atanas Bezov - Shutterstock

Your university should be in touch with you to communicate what they expect from you in terms of coursework and whether any changes will be made to your workload.

So, if you've got coursework and a deadline, you're safe to assume it's business as usual unless your professors have told you otherwise!

Make a list of all the things you've got to do and give yourself a schedule if it all feels too overwhelming. The key is setting realistic goals and chipping away at it bit by bit, instead of seeing is one massive slog.

Do you still need to revise for exams?

Credit: Cyblocker - Wikimedia

In the event that they do get cancelled last minute, you'll have revised loads anyway so you won't have to revise as much later on, and you'll get an awesome grade...

In light of the extremity of the disruptions COVID-19 has had on the academic year, there's a chance that some exams may be reformatted to other assignments.

Keep a close eye on both your student email address and your university's website for regular updates on any important changes made to your exam dates. Otherwise, get revising!

Applying to university for 2020/21 and accepting UCAS offers

Credit: chrisdorney – Shutterstock

If you're worried about them withdrawing the offer once you've accepted, don't be. It's highly unlikely that the university would withdraw an offer, so should you accept it, they'll be expecting you to start uni in September.

Contact your uni if you really need the extra reassurance, but be aware that this is a busy time for them, so patience and consideration should be at the forefront of your approach.

If you've accepted an offer but want to change your mind, get in touch with your university or college and discuss this with them.

As students are currently navigating pretty exceptional circumstances, the Office for Students has said that they expect higher education providers to allow students to change their minds if they are no longer happy with their original choice.

However, we'd advise you to only get in contact with the university once you're 100% sure of your decision to avoid a constant back and forth, as well as further confusion later on.

UCAS will be able to release you from any offer you've accepted, with the permission of the university. They expect unis to grant this permission, but if this doesn't happen and the university is unwilling to free you from the accepted offer, you should contact the OfS about this.

What happens if you lose your part-time job due to coronavirus?

Credit: Sorbis – Shutterstock

Are you entitled to sick pay?

Yes! If by some miracle you're a student with a part-time job that you're still able to do from home, but need to take time off work because you've contracted the virus, you'll be entitled to your usual sick pay.You do need to be earning at least £118/week to qualify for statutory sick pay, which currently stands at £94.25/week.

What do you do if you lost your job because of coronavirus?

When COVID-19 first hit, lots of people lost their jobs because businesses were panic-sacking employees to cover the profits they were losing out on.If you were laid off as a result of the pandemic, it's definitely worth getting back in touch with your former employer as they may be able to take you on through the government's Coronavirus Retention Scheme (which we'll explain in a second).

However, it's up to your employer whether or not they decide to make up for the wages you missed during the period of redundancy.

Coronavirus Job Retention Scheme

The government has rolled out supportive measures known as the Coronavirus Job Retention Scheme, which covers the wages of those who would otherwise have been laid off as a result of the pandemic.Grants have been given to businesses so they can pay 80% of the wages of retained employees, to be capped at £2,500/month per employee. This system basically allows employers to put people's jobs on hold, or on 'furlough', and provide them with some income in the meantime.

Wages will be paid retroactively from 1st March and the system is set to run through until October 2020, which means that if you've been put on furlough, your employer should be eligible to claim until then. As usual, we'll post updates here as soon as we get them.

How long will the Coronavirus Job Retention Scheme last?

The government has said that from 1st July, businesses will be able to bring furloughed employees back part-time.Companies will decide the hours and shift patterns their employees will work and will be responsible for paying their wages and from August the level of government grant provided through the job retention scheme will be reduced.

The idea is that employer payments substitute part of the government's contribution while staff continue to receive at least 80% of their original salary, up to £2,500 a month. Here's a timeline of how these changes will be put in place over the next few months:

- June and July: The government will pay 80% of wages up to a cap of £2,500 as well as employer National Insurance and pension contributions (employers are not required to pay anything).

- August: The government will pay 80% of wages up to a cap of £2,500. Employers will pay National Insurance and pension contributions.

- September: The government will pay 70% of wages up to a cap of £2,187.50. Employers will pay employer National Insurance and pension contributions and 10% of wages, making up 80% total up to a cap of £2,500.

- October: The government will pay 60% of wages up to a cap of £1,875. Employers will pay National Insurance and pension contributions and 20% of wages, making up 80% of wages up to a cap of £2,500.

Who is eligible for furlough?

Credit: TierneyMJ – Shutterstock

Unfortunately, if you had not been put on your employer's payroll by 19th March, your employer will not be able to put you on furlough even though you were technically employed.

Foreign nationals are eligible to be furloughed, as are apprentices who may continue to train during this time (if the circumstances permit).

So if, for example, you had a job as a barista at a coffee shop which has had to temporarily close its doors, your employer could be given a grant which is designed to cover your wages while you're on standby.

Employees of individuals who aren't companies can also be put on furlough. This may be the case if you're a nanny and you were put on payroll via HMRC's PAYE scheme on or before 19th March.

If you rely on more seasonal part-time work – like, for instance, you only work during the Christmas period or over the summer – you may not be able to claim furlough.

We encourage you to discuss this with your employer and look for alternative ways to make money should this scheme not be applicable to you.

If you had left a job to start a new one which fell through as a result of COVID-19, you may also still be entitled to furlough.

The government has also said that companies can rehire former employees that left their jobs after 28th February (the initial cut-off date) for a new job elsewhere that no longer exists because of coronavirus, in order to put them on furlough and provide them with an income.

Furlough and annual leave

It's worth noting that your employer can force you to take annual leave while you're on furlough. You should still receive your usual pay and you should also receive enough notice to do so. For instance, if you're being asked to take three days holiday, your employer should tell you this six days in advance.The government have said that while you're on annual leave, you'll need to be paid your full holiday pay. So if you're only receiving 80% of your salary at the moment your employer will need to make up the 20% so that you're receiving your full holiday pay while you're on annual leave. Show your employer this if they're not following the rules!

Coronavirus Self-employment Income Scheme

If you do part-time freelance work or any other form of self-employment, help is coming for you too.

The Coronavirus Self-employment Income Support Scheme has been rolled out to allow the self-employed to claim a taxable grant worth up to 80% of how much they were making before COVID-19 hijacked our day-to-day lives.

The grant is paid out in one instalment covering three months (March, April and May) and is capped at £7,500.

A second grant will be available from August. It will be worth 70% of average monthly trading profits, paid out in a single instalment covering three months’ worth of profits, and capped at £6,570 in total.

If you are eligible for the grant you can still work during this time (if you can), start a new trade or take on other employment.

What will happen to the SEISS over the summer?

These are the important dates for the Self-employment Income Support Scheme over the next few months:- 12th June: Further guidance will be published on the second grant. The eligibility criteria (explained below) are the same for both grants, and individuals will need to confirm that their trade has been adversely affected by coronavirus. An individual does not need to have claimed the first grant to receive the second grant (this might be you if your work has only just started to dry up because of COVID-19)

- 13th July: Deadline for individuals to apply for the first SEISS grant (worth up to £7,500)

- August: Applications for the second grant will open. Individuals will be able to claim a second taxable grant worth 70% of their average monthly trading profits, paid out in a single instalment covering three months' worth of profits, and capped at £6,570 in total.

Eligibility criteria

You can apply for the scheme if you're self-employed and:- Have submitted your self-assessment tax return for the tax year 2018/19 on or before 23rd April 2020

- Worked during the tax year 2019/20

- Are working when you apply, or would be were it not for COVID-19

- Intend to continue to work during the tax year 2020/21

- Have lost work or income due to COVID-19.

How does HMRC work out how much you get?

How much you'll get from the scheme will be based on how much you earned during the tax years 2016/17, 2017/18 and 2018/19.HMRC will work out your average trading profit by adding together your total trading profits or losses for the three tax years, which will then be divided by three (the online service will tell you how HMRC worked it out in more detail). The end result will be how much you are entitled to.

How do you apply for a grant through the Self-employment Income Support Scheme?

The Self-employment Income Support Scheme has been live since 13th May. However, HMRC's website states that you should use their online tool to find out whether or not you'll be eligible for a grant before you make a claim.

If this tool says that you are eligible, HMRC will give you a date on which you'll be able to make a claim and you'll also be asked to add in your contact details so they can get in touch with you if need be.

To be able to use this tool, you'll need to have your Self Assessment Unique Taxpayer Reference (UTR) number and your National Insurance number to hand. If you don't have these, there's a link to where you can find them in the following section.

If you're eligible to make a claim

To apply for support from HMRC you'll need:- Your Self Assessment Unique Taxpayer Reference (UTR) number (if you've lost your UTR number, here's how to find it)

- Your National Insurance number (if you've lost your NI number, here's how to find it)

- Your Government Gateway user ID and password (you can create one online if you don't already have one)

- The bank account number and sort code of the account you'd like the grant to be paid into.

You can make a claim for Universal Credit while you wait for the grant. Any support you get from this Self-employment Income Support Scheme may affect how much Universal Credit you get from here on out, but should not affect claims for earlier periods.

If you're not eligible to make a claim or think HMRC has made a mistake

If after making a claim HMRC has deemed you ineligible and you're not satisfied with this outcome or you think HMRC has miscalculated your grant, you should get in touch with them with the following information:- Your grant claim reference

- Your National Insurance number

- The UTR number you used on your claim

- The Government Gateway user ID you used to make a claim

- Details about why you think the grant amount or eligibility outcome is wrong.

Otherwise, contact HMRC here and ask them to review your situation.

Can you get money back on cancelled events and subscriptions?

As public gatherings of more than two people who don't reside in the same household have been banned, most ticketed events will not be going ahead, nor will you be going to the gym for a while...Can you get a refund for festival and concert tickets?

As summer is still a way off, not all festivals have been cancelled – but it's likely that the majority will be.

Glastonbury 2020 has officially been cancelled, and the organisers are offering two options for people who've already paid the deposit on their tickets: a complete refund, or the possibility of rolling over their deposit for next year, ensuring tickets for Glastonbury 2021.

If you've bought a ticket for a festival, concert, play or other event that has been cancelled, you should get a refund.

According to Ticketmaster's policy:

If an event is cancelled altogether, we'll usually just refund your tickets automatically. We refund the face value plus the service charge for each ticket – you'll see a credit onto your card within 15 days of us emailing you about the cancellation.If you've incurred any other losses as a result of an event being cancelled (e.g. you've booked a hotel which you'll no longer be staying in), get in touch with the company directly to see whether they'll give you a refund or allow you to rebook at a later date.

Don't forget to check your travel insurance if you've had to cancel any transport you had booked to get to your concert or festival!

Can you get a refund for your gym membership?

Now we're all living that working/studying from home life, going to the gym is (temporarily) a thing of the past.

PureGym, Nuffield and The Gym Group are freezing their customers' memberships while freedom of movement is restricted, during which time they won't be charged.

Check your gym's webpage to find out what their response has been to COVID-19, and don't hesitate to get in touch with them if you feel that you may have been wrongly charged for services you won't be able to use.

There are loads of ways to stay fit and healthy without going to the gym anyhoo!

Can you get a refund for a Sky Sports or BT Sport subscription?

Credit: wonker - Flickr

BT Sport and Sky Sports customers (including customers subscribing to these packages via other providers) were able to pause their subscription free of charge during March, April and May as there was almost no live sport taking place.

However, the men's Premier League and Championship football are both due to restart in June, with golf and snooker resuming too. As some sports events are returning, both providers have said that they'll start charging their customers again from mid-June.

More information for customers via the links below.

Getting money back for travel that has been cancelled due to coronavirus

Credit: Ceri Breeze – Shutterstock

Can you get a refund for train tickets?

To avoid the train companies going bust, the government has temporarily taken charge of the rail operators. A lot of services have been reduced, but you can get a refund for most train tickets, even for tickets that are usually non-refundable.Advance, Off-peak, Super off-peak and Anytime tickets

Train companies have agreed to refund Advance tickets bought before and valid for travel from 7am on 23rd March, and have waived the usual £10 admin fee you'd usually pay to be refunded.You should also be entitled to a refund for any partially used tickets (i.e. when only one of the journeys has been completed), also with no admin fee.

There are some cases where Advance tickets won't be eligible for a fee-free refund, so we suggest you double-check with your operator before going ahead.

Season tickets

You can get a refund on your Season ticket if:- Your weekly Season ticket has three or more days validity remaining

- Your monthly Season ticket has seven or more days remaining on it

- Your annual Season ticket has eight or more weeks remaining or six weeks remaining for TfL Travelcards.

Transport for London

TfL will refund any travelcards which have been loaded onto your Oystercard and will wave its £5 admin fee. Some tube stations have been closed and there is a reduced service on most lines and no night tubes.Buses will continue to run but at a reduced capacity and night buses are still running to support those having to complete essential travel to work night shifts.

Can you get a refund on coach tickets?

Credit: Michaelpuche – Shutterstock

National Express

National Express coaches were suspended on 5th April. Any travel booked after that date can be postponed to any time over the next 12 months free of charge, or you can request a full refund.Megabus

Megabus also suspended all services in England and Wales from 5 April, in line with government guidance on non-essential travel. Services in Scotland will continue to run in partnership with local bus services.Megabus have said that customers with travel booked on services in England and Wales after 5 April will receive an email and be refunded.

If you had a trip booked with Megabus but haven't received an email with your refund, the company has advised that you get in touch with their Customer Services Team by emailing enquiries@megabus.com.

Stagecoach

Essential routes will be maintained where possible and temporary timetables have been put in place so we advise you to check the status of your trip online. There is no blanket policy about refunds at this time, so customers are encouraged to get in touch with the Customer Services team if they are no longer able to travel.Can you get a refund for cancelled flights and holidays?

So, we're all supposed to stay at home. But what about that upcoming trip to Ibiza you had planned with the lads?

The Foreign and Commonwealth Office is advising British nationals against all but essential international travel. This means that it is advisable to cancel any holidays and other non-essential trips abroad you had planned (including your sesh in Ibiza, soz).

Can you get flights refunded if you cancel because of coronavirus?

If you booked flights but have had to cancel your trip, even if you booked with a low-cost airline who have a no-refund policy, it's worth getting in touch with the company.Airlines are introducing new policies for customers cancelling their trips as a result of the pandemic. These involve either waiving admin fees on any amendments made to bookings, giving customers a voucher towards their next trip or providing a full refund.