I’m a 30-year-old bachelor that works from home, and I no longer worry about money.

For many years I worried about money, but now I spend time enjoying it.Very few people wake up one day and just become wealthy. It’s is a choice that you make and a way that you live your life.

It took me a long time and a ton of hard work, but I finally learned how to get rich quick realistically. I’m certainly not super-rich, but my money mindset has changed dramatically.

Most of us don’t get rich quick; it’s a journey. So, how did I do it? How can I possibly teach you how to get rich quick?

Here’s how I got rich quick (realistically):

Just in case you’re a busy professional who only has time to read lists, all you need to know to get rich is the following:

- Realize you suck with money and believe wealth is possible for you.

- Start investing now, your future self will thank you.

- Educate yourself on money and learn to build wealth the right way.

- Make more money and live a life that can make success happen for you.

- Listen to our podcast and free your inner financial badass.

Investing

Being frugal is important, but it’s only one side of the coin. Cutting your fancy cappuccino habit to save a few bucks isn’t going to push the needle for you. While there is a limit to have much we can save, there is no limit to how much we can earn.Investing in the Market

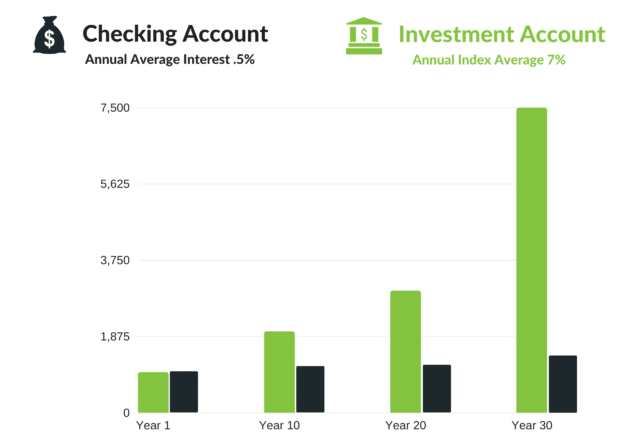

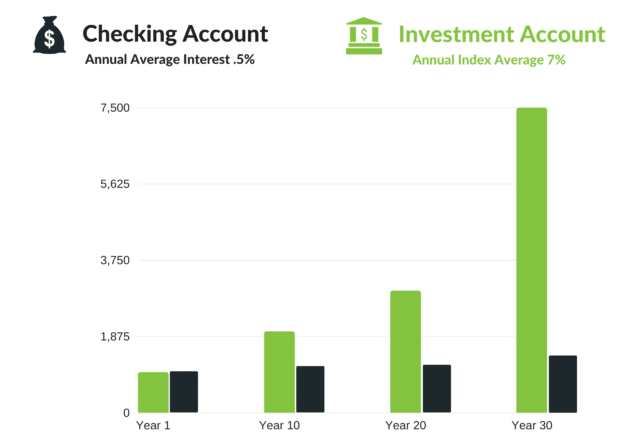

The easiest and the most efficient way to grow the money you’ve already saved is through investing in the stock market. The best part is it doesn’t take much work on your part; it can be put on autopilot.No, investing in the stock market will not make you rich overnight. It’s a slow, steady and consistent way to build wealth. With a 7% average yearly gain, your initial investment will double ten years.

You can’t do that keeping it in a savings account. In fact, in 10 years, your savings will be worthless because of inflation.

We love Betterment for beginner investors because there is no minimum, the fees are low, and you don’t need to know anything about investing to get started.

Invest in Real Estate

Real estate can make you make you rich, but you need a little more money to get started here. If you are reading this you probably not ready for real estate investing just yet but you might want to put it on your list of goals. Investing in turnkey rental properties can have fantastic returns.Roofstock is great, I created a free account and asked them a ton of questions a year before I even got started and they were more than happy to answer all my questions.

If you are interested, we have a bunch of resources and podcast episodes you can check out. We cover everything from cash flow to the tax benefits.

If you are looking to invest in real estate but looking for something a little more hands-off check out Fundrise where you can invest in crowdfunded real estate projects.

Take Away: You have unlimited earning potential. The only thing that is stopping you from earning more is you.

Less Stuff = More Money

Just a year ago, I worried about money all the time. I never had enough money to live the life I wanted, but I was able to pay my bills. I owned a condo that ran me close $2,000 a month, a BMW that cost over $400 a month, and a bunch of stuff inside of both. I needed at least $3,000 a month just to keep up with my stuff.Then, I lost my job. I needed to downgrade my life, or I wasn’t going to make it. I sold the BMW and bought a Honda Civic for half the price. I rented out my condo and moved in with my younger brother — reducing my monthly living expenses dramatically.

I made a list of what was important to me and what was not. I sold every non-essential I could to make extra cash.

Why do you need all that stuff?

If I were to take an inventory of my life and determine the things I use every day, it would be a bed, a chair, the car, the computer, a frying pan, and a French press. Those are the thing I couldn’t live without. The rest of the stuff I rarely use.

When I had this epiphany about stuff, everything changed. The way I thought about money shifted dramatically.

Do I Need This?

If you’re buying stuff every day, you need to take a step back and think about it. I like to create a 30-day list on my phone of things I’d like to buy.If I see something in a store or online, instead of clicking buy I just put it on my list. That curbs the urge. 95% of the time, I end up not wanting it in 30 days. I also always ask myself- Do I need this? Will it make my life that much better?

Most of the time, it won’t. Most of the time I can’t even remember why I wanted that thing I put on the list anyway. If you do need to buy stuff make sure you get the best price for the best quality.

Take Away: Stuff costs money. Keeping stuff in your house costs money. Using stuff costs money. Less stuff, more money.

Educate Yourself

Financial education is your best investment. I made it my New Year’s resolution to educate myself about money — since I spent almost 20 years being terrible with it.I read two books: The Simple Dollar and I Will Teach You To Be Rich. Start there. We also created an awesome podcast where we drink beer and talk money to help make it all a bit easier

Invest in yourself, in your education. There's nothing better. -Sylvia Porter

Tweet This

The one thing I learned was debt is the devil. Both books drilled into my head that I should be debt free.Tweet This

Debt is The Devil

Now that I was a streamlined bachelor with very low living expenses and nothing to buy, I had some available cash. I decided to pay off my credit card debt. Having no debt is freedom and an idea I could get behind.Having debt while trying to achieve financial independence is like driving with your foot on the brake. While debt can be valuable and even profitable if used correctly, too many people spend money they don’t have.

Bad debt, like credit card debt, compounds many times faster than the best investments ever could and can quickly outpace your ability to earn and pay it off.

The good news is, you don’t have to bury yourself in debt. However, the minimum payment is not going to cut it. Attempting to escape debt with minimum payments is like trying to toast bread with a flashlight.

I did some more research to determine the right method for paying off my debt, and I found the stack method. I won’t go into detail, but you can read about it here.

You refinance all the debt you can and then prioritize the most expensive debt first.

It can also help to have someone negotiate your debt away for you.

Student Loans Suck

I don’t personally have student loans, but I know many people like my brother who are making that dreaded payment every month. From now until what seems like an eternity, a few hundred bucks out the window every month.The interest on those loans will ruin you. The quickest way to reduce your student loan balance and pay less interest is to refinance.

Companies like Earnest can dramatically reduce that rate and save you a ton on your loan.

Take Away: No stress, no debt, uh, that’s freedom! A feeling better and longer-lasting than sex. If you need a little help, we have a free book here to help you with your debt reduction plan.

Make More Money

Invest in Yourself

Not every investment has to start with money. Making some simple changes in your lifestyle can drastically improve your life and work which in turn can make you more money.Are your friend’s ballers? Do they go out all the time a spend tons of money on expensive dinners, gadgets and other crap they don’t need? If your friends are not financially responsible, it is going to be harder for you to be responsible.

You want to surround yourself with people who have the same goals as you and people you can learn from. You need financial friends. It’s probably about time that you got financially naked.

The best way to keep bumping your income is to move jobs every few years. People who change jobs often, make 50% more over their lifetime compared to those who stayed at jobs longer.

If you don’t feel you have the skillset to find a better position, then upgrade your skills. Take a class or read some books. It can help you get to make more money at your current company or help you find a better spot a new one.

Invest in Building your Own Business

Who doesn’t want a little (or a lot) more money? There are many great ways to grow your income streams outside of your day job. From selling crap you don’t need, to building a side business, it’s always an excellent idea to make some extra money. It can help you pay off debt quicker, grow your investments faster or even turn into a full-time gig.Earning some extra cash on the side can be fun, it will increase your level of income security and confidence. There are also a ton of tax incentives for small business owners.

Never depend on a single income. - Warren Buffett

Tweet This

Want to earn some passive income and start your side hustle? Most successful people have become rich through starting their own businesses. Learn how other successful entrepreneurs and millionaires made their money. Get inspired and get to work.Tweet This

I’m a skilled web designer, and I knew I could make money by designing a few websites. I started reaching out for work by cold emailing and walking into local businesses. With the extra income, I paid off my debt in a few months. I didn’t have a ton of debt, to begin with, but I’ve been sitting with it for over 15 years.

I now realized I had extra money because it wasn’t going towards paying my credit card bills — this was on top of the fact that my living expenses were much lower than they were. I found myself with a lot of extra income.

5. Track Your Net-worth

Taking a hard look at your financials can be scary, especially if you’re in the negative. But if you want to be rich, you can’t avoid it forever and the best time to face your fear is now. You will feel relief when you know where you stand financially instead of just guessing. Then you can set goals and track them.What gets measured gets managed. - Peter Drucker

Tweet This

Net worth is probably the most important financial number you can track. It’s a simple way to see your financial life with a few basic calculations. Every month income comes in, and expenses go out to pay bills and rent. If after all your expenses are paid if you still have some money left over – that’s great. Now you have money to invest and grow.Tweet This

Personal Capital is a great tool to budget and track your net worth, and it’s free to sign up.

Living below your means is the simplest way to save money. If you are in the negative month after month, then it’s time to look at your budget and see where you can cut and how you can make more money to make ends meet.

How Will You Get Rich Quick?

A total life transformation won’t happen overnight, but it will start to slowly take shape with each choice. Action will be the key to success. You also need to learn about personal finance. That knowledge is critical if you want to achieve financial freedom.Building wealth is not something you will just stumble upon one day. It’s something you work at every day, forever.

from Fruitty Blog https://ift.tt/2Xyb9Nt

via IFTTT

No comments:

Post a Comment